Introduction:

India ka banking sector ek nayi soch ke sath transform ho raha hai, jisme Neo-Banks aur AI-driven digital services ka bada role hai.

Pehle jahan banking ka matlab lambi lines, paperwork aur branch visits tha, ab wahi process sirf ek app par few clicks me ho raha hai.2025 tak, AI aur Neo-Banks in India 2025 ek aisi technology ban gaye hain jo har ek Indian customer ke liye faster, smarter aur safer banking experience laa rahe hain.

Neo-Banks aur AI kya hain?

Neo-Banks kya hote hain?

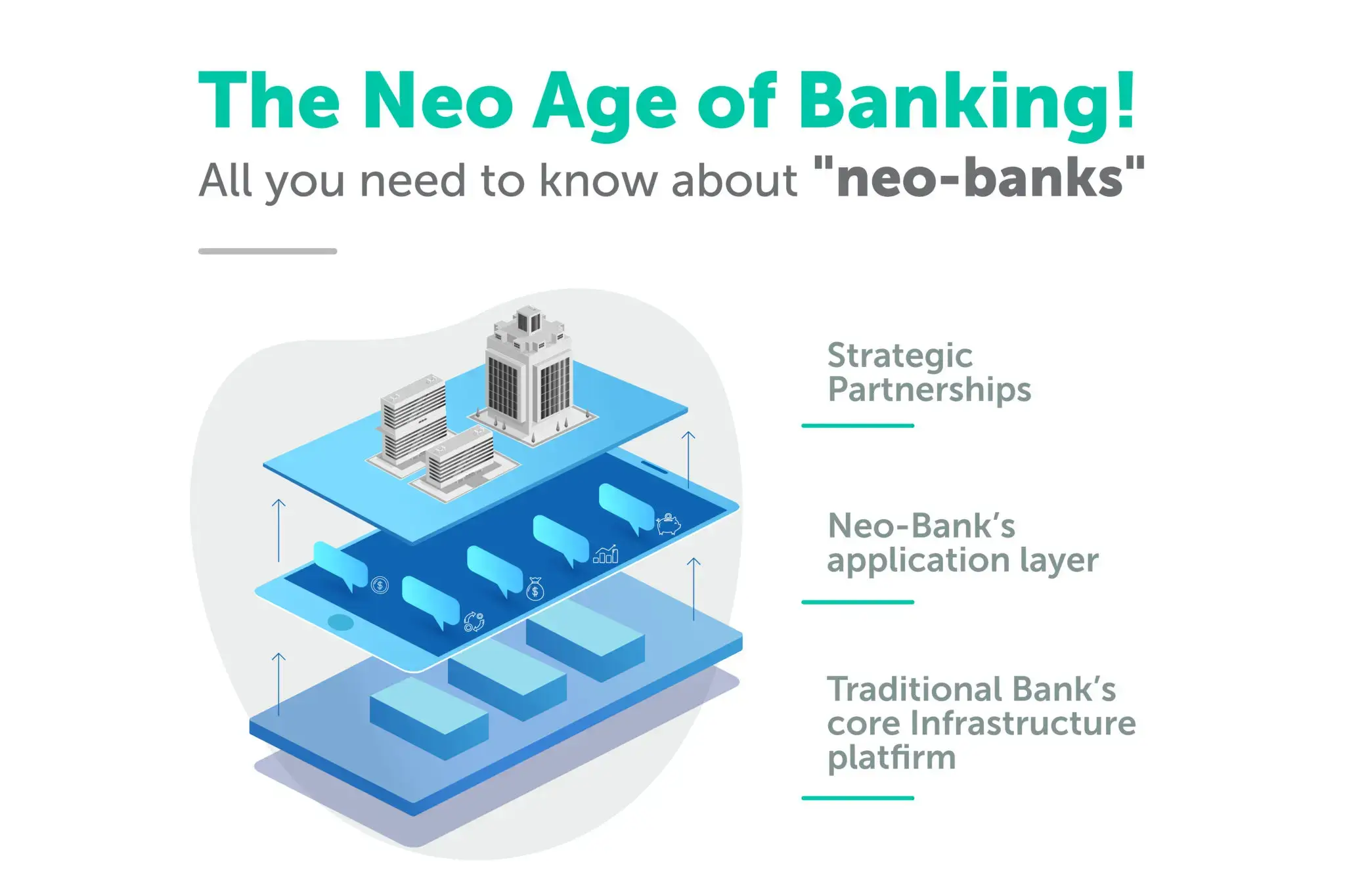

Neo-Banks ek digital-only bank hote hain jinka koi physical branch nahi hota.

Saari banking services ab sirf mobile app ya website ke zariye hi handle hoti hain.

Low-cost services, fast transactions aur customer-friendly UI inki khasiyat hai.

AI ka role Neo-Banks me:

Artificial Intelligence (AI) neo-banks ke liye ek game-changer hai. Ye technology help karti hai:

Fraud detection aur real-time monitoring

Personalized investment suggestions

24/7 AI chatbots for customer support

Data-driven decision making

📗Read Also:

👉 India Mein Digital Gold Investment 2025: Safe Hai Ya Risky? Full Guide for Beginners

👉 SIP vs FD vs Gold 2025 – Best Investment Option in India? Full Comparison

AI aur Neo-Banks in India 2025: Digital Banking ka Naya Yug:

Digital banking ka naya yug shuru ho chuka hai jahan AI aur Neo-Banks in India 2025 ek game-changer sabit ho rahe hain. Personalized loan approvals, automated savings plans aur robo-advisory services customers ke liye ek smart aur time-saving solution ban gaye hain. Ye trend clearly dikhata hai ki agle kuch saalon mein Neo-Banks AI ke bina imagine hi nahi kiye jaa sakte.

Benefits of AI aur Neo-Banks in India 2025:

Fast & Simple Account Opening – Aadhaar aur PAN ke through bina paperwork ke account ban jata hai.

24/7 Customer Support – AI-based chatbots hamesha available hote hain.

Low-Cost Banking – Traditional banks ke comparison me kam charges.

Faster Transactions – Real-time UPI & IMPS payments without delays.

Personalized Finance Management – AI suggest karta hai best savings/investment options.

Secure Transactions – Fraud detection algorithms ke wajah se extra security milti hai.

Challenges of AI aur Neo-Banks:

Trust Issues – Har koi digital-only bank par trust nahi karta.

Regulatory Restrictions – RBI abhi bhi strict norms aur continuous monitoring follow karwa raha hai.

Digital Divide – Har ek Indian ke paas smartphone ya internet access nahi hai.

Cybersecurity Threats – Hackers ke attacks aur data breach risk hamesha hota hai.

Future of AI aur Neo-Banks in India 2025:

Financial Inclusion – Rural India tak reach karne ka biggest plan hai.

AI-Powered Investments – Personalized investment portfolios aur robo-advisors.

Voice Banking – AI ke through sirf voice commands se banking possible hogi. 🎙️

Global Expansion – Indian neo-banks abroad bhi expand karenge.

Stronger Regulations – RBI aur government inko officially recognize aur secure karenge.

Conclusion:

AI aur Neo-Banks in India 2025 banking ko ek nayi direction de rahe hain.

Jahan speed, convenience aur personalization milega, wahi kuch cybersecurity aur trust challenges bhi exist karte hain. Lekin agar India in challenges ko handle kar leta hai, to future me Neo-Banks hi India ka primary banking model ban sakte hain.

FAQs:

Q1: Neo-Banks aur Traditional Banks ke beech main difference kya hai?

👉 Neo-Bank 100% digital hote hain, physical branch nahi hoti. Traditional bank ke paas dono hote hain.Q2: Kya Neo-Banks safe hain?

👉 Haan, AI fraud detection aur RBI ke regulatory frameworks ke wajah se ye kaafi safe hote hain.Q3: India me kaunse popular Neo-Banks hain?

👉 Fi Money, Jupiter, RazorpayX, Niyo aur Open sabse popular neo-banks hain.Q4: AI ka future banking me kya role hai?

👉 AI fraud detection, customer support, investment guidance aur risk management me kaam aata hai.Q5: 2025 tak kya Neo-Banks purane traditional banks ki jagah le lenge?

👉 Completely replace nahi karenge, lekin digital adoption ke wajah se inka market share bahut badh jayega.Q6. Kya AI Neo Banks India mein safe hain?

👉 Haan, AI ke fraud detection aur RBI regulations ki wajah se ye secure hain.Q7. AI aur Neo Banks in India se traditional banks khatre mein hain kya?

👉 Traditional banks ko compete karna padega, lekin dono ka coexistence hoga.Q8. Kya AI Neo Banks sirf youth ke liye hain?

👉 Mostly youth adopt kar rahe hain, but future mein sabke liye accessible honge.Q9. AI Neo Banks mein investment safe hai kya?

👉 Haan, kyunki ye RBI ke framework mein operate karte hain aur AI fraud risk minimize karta hai.Official: Reserve Bank of India – FinTech and Digital Banking Updates

AI aur Neo-Banks in India 2025 – Opportunities, Challenges & Future of Digital Banking