Introduction – Paisa Kahan Lagayein 2025 Mein?

2025 mein financial planning sirf saving nahi, smart investing bhi ban chuki hai. Aise mein sabse common sawal hota hai –

“SIP karein, FD mein paisa dalein ya phir Gold kharidein?”Aapka investment goal chahe tax bachaana ho, long-term wealth banana ho ya short-term safety chahiye ho — options kaafi hain. Is blog mein hum detail mein samjhenge SIP vs FD vs Gold 2025 ke pros & cons, return comparison, aur kis situation mein kaunsa option best hai.

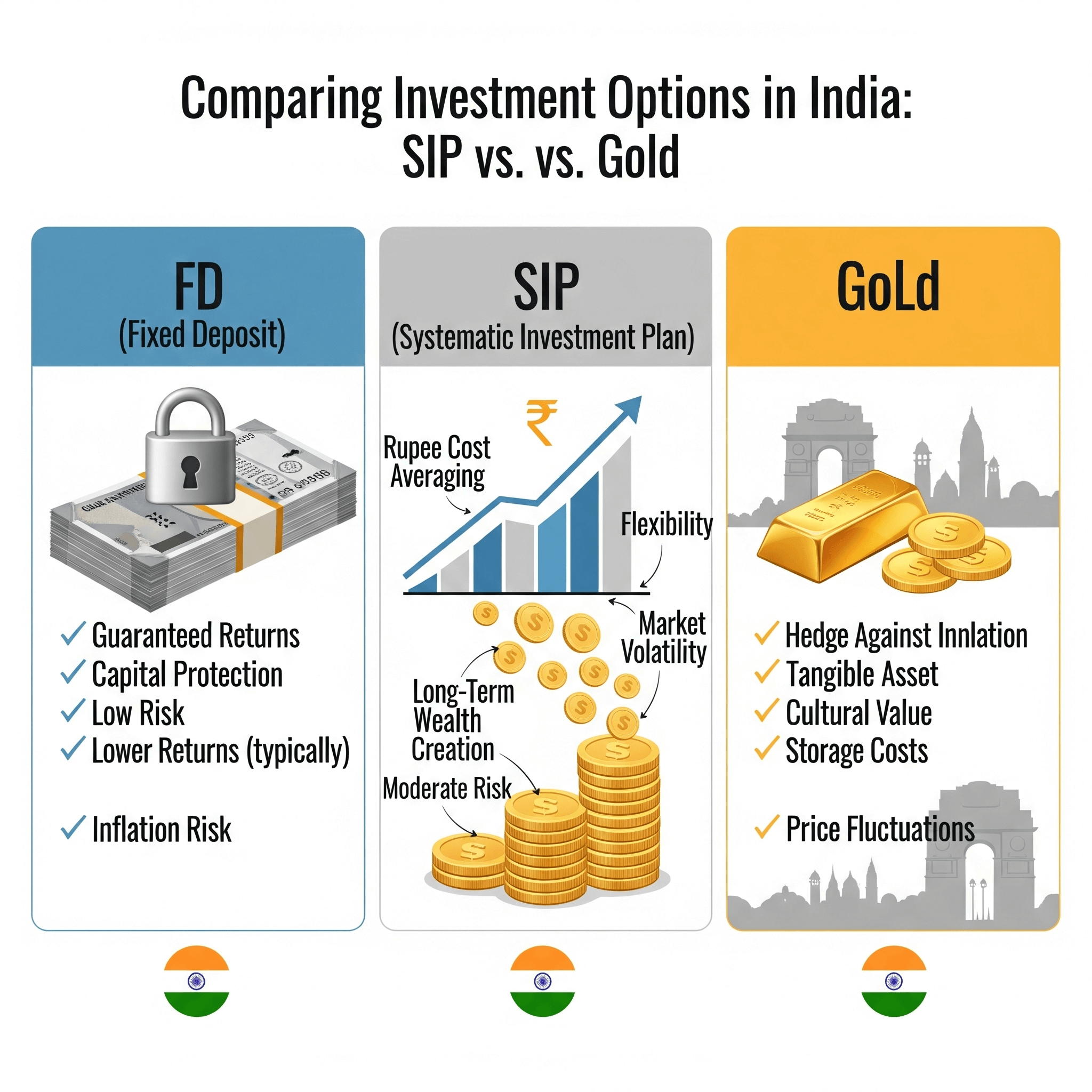

Quick Comparison – SIP, FD aur Gold (2025):

Feature SIP (Mutual Funds) Fixed Deposit (FD) Gold Investment Returns 10–15% (avg) 6–7.5% 8–10% (5-year avg) Risk Level Moderate to High Very Low (Safe) Medium (depends on price) Lock-in Period Optional (ELSS – 3 yrs) 1–5 years Flexible (digital/physical) Liquidity High (exit anytime) Medium (penalty if early) Medium (easy to sell) Tax Benefits ELSS SIP gives tax benefit Under 80C (5-yr FD) No tax benefit (except Sovereign Gold Bonds)

📈 SIP – Smart Investment for Long Term Goals:

SIP yaani Systematic Investment Plan ek aisa smart method hai jisme aap har mahine ek fixed amount mutual funds mein invest karte hain. Yeh long-term wealth create karta hai aur compounding ka full benefit deta hai.

✅ Pros:

Higher returns than FD/Gold

Flexible amount & duration

Long-term goals ke liye best

SIP in ELSS = Tax Saving bhi

❌ Cons:

Market risk hota hai

Short-term volatility possible

Recommended For:

Young investors, long-term planners, inflation-beating growth seekers

FD – Safe & Stable Investment Option:

Fixed Deposit (FD) ek traditional aur secure option hai jahan aapko guaranteed returns milte hain — perfect for risk-averse investors.

✅ Pros:

Safe & secure returns

Bank/NBFC par depend karta hai

Senior citizens ke liye extra interest

❌ Cons:

Low returns (inflation se kam)

Early withdrawal pe penalty

Recommended For:

Senior citizens, short-term planners, low-risk investors

📗Read Also:

👉 India Mein Digital Gold Investment 2025: Safe Hai Ya Risky? Full Guide for Beginners

👉 SIP vs FD 2025 – Beginner ke liye Best Investment Guide

Gold – Emotional & Traditional Investment:

India mein Gold investment sirf return nahi, ek culture bhi hai. Aaj kal log physical gold ke alawa Digital Gold, Sovereign Gold Bonds (SGB) aur Gold ETFs bhi prefer karte hain.

✅ Pros:

Hedge against inflation

Liquid & universally acceptable

Portfolio diversification

❌ Cons:

Storage/safety issues (physical)

Gold prices fluctuate karte hain

No fixed return

Recommended For:

Diversification ke liye, long-term storage of value, festival buyers

SIP vs FD vs Gold – Kis Ke Liye Kya Best Hai?

Investor Type Best Option Young salaried person SIP (Wealth Creation) Retired / Risk-Averse FD (Safety & Stability) Portfolio Diversification Gold (Physical/Digital) Tax Saving Purpose SIP (ELSS) or 5-yr FD

Real Returns Comparison (Inflation Adjusted 2025):

Investment Avg Return After Inflation (4.5%) SIP 12% ~7.5% real return FD 6.5% ~2% real return Gold 9% ~4.5% real return 👉 Clearly, SIP vs FD vs Gold 2025 comparison mein SIP long-term mein best performance deta hai..

SIP vs FD vs Gold 2025 – Risk Analysis:

Agar aapka primary goal hai risk-free investment, to Fixed Deposit (FD) 2025 mein bhi sabse safe mana ja raha hai. FD par capital loss ka risk bahut kam hota hai, lekin inflation ko beat karna mushkil ho sakta hai.

Wahin agar aap moderate risk le sakte hain aur long-term wealth banana chahte hain, to SIP (Systematic Investment Plan) 2025 mein bhi ek strong option hai. SIP mutual funds mein invest karta hai jahan returns market performance par depend karte hain. Lekin average 10–14% annual return milne ka chance hota hai.

Gold investment bhi relatively safe mana jaata hai, lekin 2025 mein gold prices kaafi fluctuate kar rahe hain. Agar short-term mein invest kar rahe ho, to gold risky ho sakta hai. Long-term mein inflation hedge zarur deta hai.

SIP vs FD vs Gold 2025 – Family Investors ke liye Best Option?

Agar aap ek middle-class family se hain aur future planning jaise bacchon ki education, retirement, ya house purchase ke liye invest kar rahe hain, to SIP 2025 sabse smart choice ho sakta hai. FD mein safety milegi lekin growth nahi. Gold emergency ke liye theek hai, lekin consistent growth ke liye nahi.

Conclusion – Kya Choose Karein 2025 Mein?

Agar aap long-term wealth create karna chahte hain aur thoda market risk le sakte hain to SIP sabse best option hai.

Agar aap safe aur secure returns chahte hain bina market ke tension ke, to FD better choice hai.

Aur agar aap diversify karna chahte hain apna investment portfolio, to Gold zaroor include karein.✅ Best Strategy: SIP + FD + Gold ka balanced combo banayein according to your financial goals.

Pro Tip:

Aaj ke time mein hybrid strategy best hoti hai. Matlab kuch amount FD mein, kuch SIP mein aur thoda sa Gold mein. Isse aapke portfolio mein balance, safety, aur growth tino milega.

FAQs – SIP vs FD vs Gold 2025

Q1. SIP ya FD, kaunsa better hai 2025 mein?

👉 SIP long-term mein zyada return deta hai, lekin FD safe hai. Aapke goal pe depend karta hai.Q2. Kya Gold mein abhi invest karna sahi hai?

👉 Haan, inflation ke khilaaf protection ke liye gold ek reliable option maana jaata hai. Digital gold ya Sovereign Gold Bonds consider karein.Q3. SIP mein tax benefit kaise milta hai?

👉 ELSS (Equity Linked Saving Scheme) wale SIP mein ₹1.5 lakh tak 80C ka benefit milta hai.Q4. Kya teenon mein invest kar sakte hain?

👉 Haan, diversified investment strategy best hoti hai — SIP for growth, FD for safety, Gold for stability.Q5. SIP vs FD vs Gold 2025 – Best long-term investment option kaunsa hai?

👉 Long-term ke liye SIP best mana jata hai due to higher returns, lekin SIP vs FD vs Gold 2025 ka choice aapke risk appetite par depend karta hai.Q6. SIP vs FD vs Gold 2025 – Kis option mein kam risk hota hai?

👉 FD aur Gold low-risk investment choices hain, jabki 2025 mein SIP thoda zyada risk involve karta hai, lekin uske saath higher return ki possibility bhi hoti hai.Q7. SIP vs FD vs Gold 2025 – Kis option me tax benefits milte hain?

👉 ELSS SIP aur 5-year FD me tax benefits milte hain; SIP vs FD vs Gold 2025 me SIP (ELSS) best tax-saving option hota hai.Official: RBI Sovereign Gold Bond Scheme